Managing trust assets in the current environment calls for a deep understanding of investment markets and comprehensive knowledge of the legislative landscape, including tax codes. It also necessitates exceptional foresight, anticipating how today’s decisions will shape future outcomes.

The primary challenge lies in honoring the grantor’s intent while satisfying beneficiaries’ expectations regarding the distributions’ size, stability, and longevity. In some cases, a trustee can use new tools to fulfill these expectations, but when trust goals conflict, inevitable trade-offs arise. As experienced trustees will readily confirm, pressure from beneficiaries can further complicate decision-making.

Trustees, as fiduciaries, are guardians of the process, not necessarily the guarantors of success. They deal with probabilities rather than certainties when it comes to the trust portfolio. Understanding these probabilities and mapping a viable path toward the trust’s objectives is at the heart of a trustee’s responsibilities.

The trustee must diversify the investments. In the investment and management of trust funds, a trustee should consider a daunting list of factors that may be relevant, including general economic conditions, the possible effects of inflation or deflation, the expected tax consequences of investment decisions, the expected total return, and the beneficiaries’ other resources and liquidity needs. In practice, trustees must determine an effective asset allocation strategy for the trust and the beneficiaries.

Trustees must exercise the power to adjust and enumerate the important factors to consider: the nature, purpose, and expected duration of the trust; the intent of the grantor; the effect of economic conditions on principal and income; and the anticipated tax consequences of any adjustment.

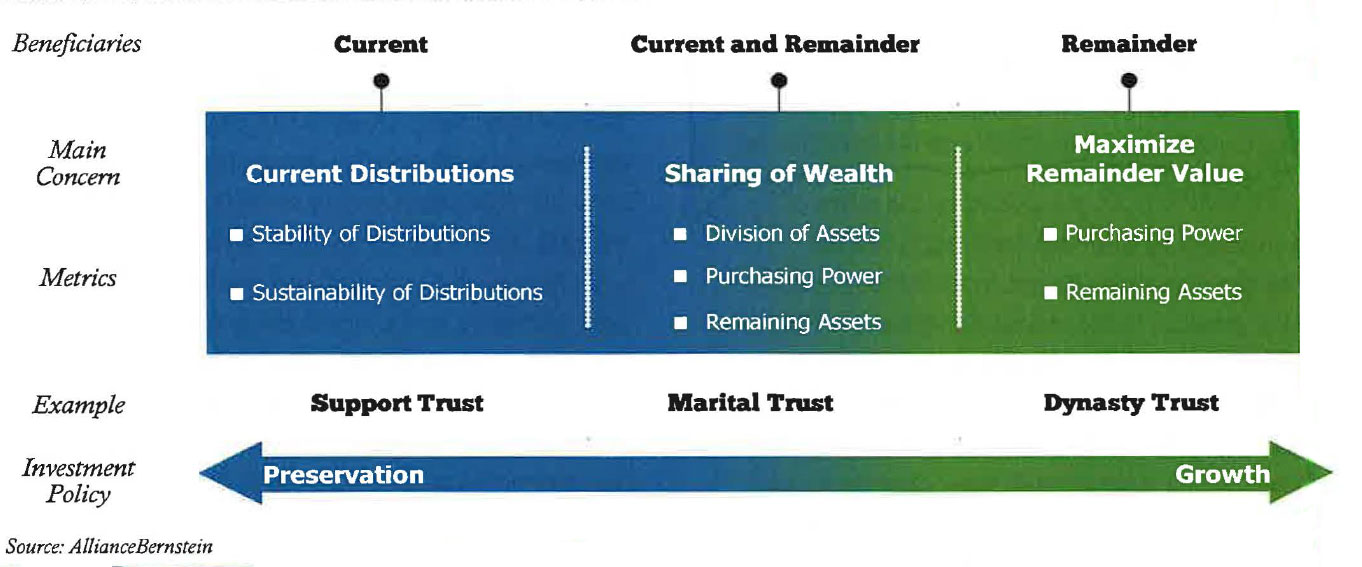

The Trust Spectrum

Where Does Your Trust Lie on This Spectrum?

Trusts are created for myriad reasons, their terms differ widely, and everyday beneficiary has different needs. Fiduciaries must customize the administration of each trust accordingly.

Trusts Focusing on Current Beneficiaries

This group, which includes support trusts, appears at the left side of the spectrum. The main concerns are the stability and sustainability of the distributions to the current beneficiary. The investment policy typically aims for wealth preservation, but some growth may be sought to maintain the desired distributions.

Trusts Focusing on Current and Remainder Beneficiaries

In the middle of the spectrum lies trusts, such as certain marital trusts, created to share wealth between two kinds of beneficiaries. Current beneficiaries seek stable and sustainable distributions, but remainder beneficiaries focus on the purchasing power and size of the remainder. Both are concerned with the division of trust assets. Because the interests of current and remainder beneficiaries are often divergent and sometimes opposing, this type of trust is inherently more difficult to administer. A trustee will typically choose an investment policy that mixes wealth-preserving assets and growth assets.

Trusts Focusing on Remainder Beneficiaries

On the far right of the spectrum lie trusts, such as dynasty trusts, that focus primarily on the interests of future generations or the remainder beneficiaries. Here, the main concern is to retain purchasing power and maximize remainder value. Fiduciaries of such trusts generally make heavy allocations to growth assets.